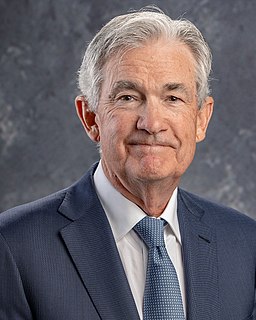

Powell at Jackson Hole: Rate Cuts on the Horizon?

<a href="https://commons.wikimedia.org/wiki/File:Jerome_H._Powell,_Federal_Reserve_Chair.jpg">Federalreserve</a>, Public domain, via Wikimedia Commons

-

Federal Reserve Chair Jerome Powell spoke Friday at Jackson Hole, and markets are buzzing.

- Key takeaway: He hinted conditions “may warrant” rate cuts as soon as September—but stopped short of a firm commitment.

Highlights from Powell’s Speech

- Inflation progress: Cooling toward the Fed’s 2% goal.

- Employment: Still strong, though job growth has slowed.

- Risks: Balanced for the first time in years—neither runaway inflation nor deep recession is dominant.

- Strategy: Fed is shifting from fighting inflation to supporting sustainable growth.

Market Reaction

- Stocks jumped: S&P 500 up over 1% Friday.

- Bond yields fell, signaling investor confidence in lower borrowing costs ahead.

- Dollar softened, helping exporters.

What It Means for Business

- Cheaper borrowing: Rate cuts could ease financing for companies and consumers.

- Retail & housing: Sectors tied to credit could see renewed momentum.

- Investors: More appetite for equities as rates decline.

- Small businesses: Relief from high credit costs—though timing remains uncertain.

What to Watch Next

- September Fed meeting: Will Powell follow through?

- Economic data: August jobs report and inflation numbers will heavily influence the decision.

- Global impact: Other central banks may follow the Fed’s lead.